A Big-Data-Based Patent Valuation System

Calculate the monetary value of patents in real-time with a click of a button

A New Concept

Patent valuation is becoming increasingly important as revenue generated from intellectual property continues to grow. Although there are several well-known methods for patent valuation – including the income approach, cost approach, market approach and option approach – it can be difficult to apply these in practice. This is largely due to the fact that there is insufficient empirical data to support these methods and they rely too heavily on subjective factors.

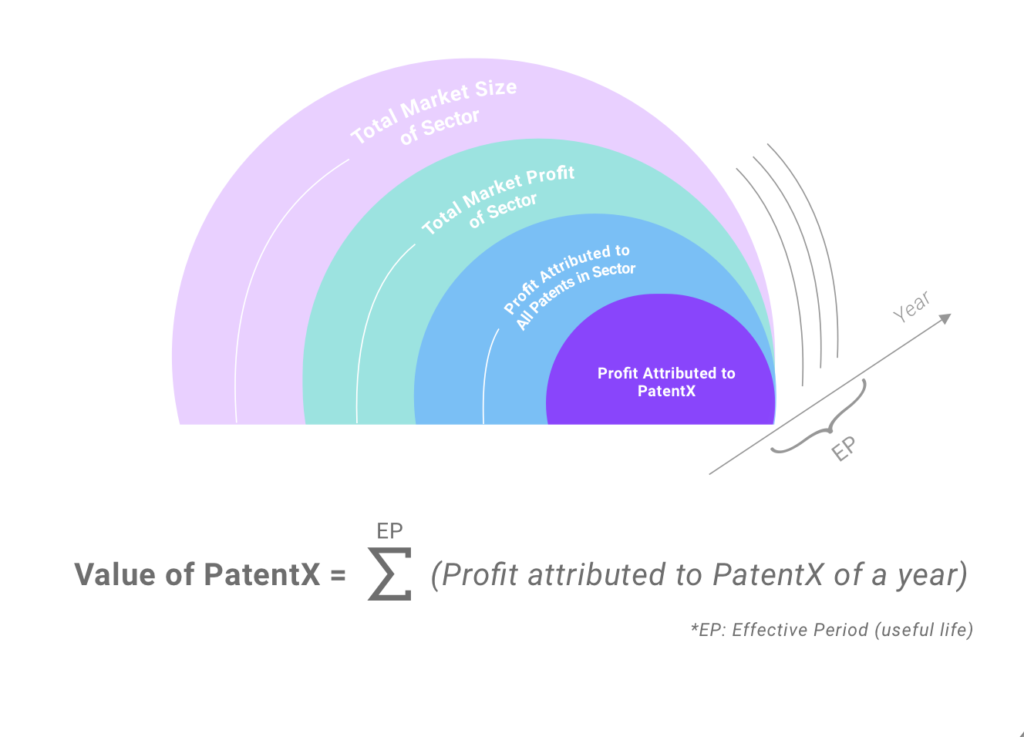

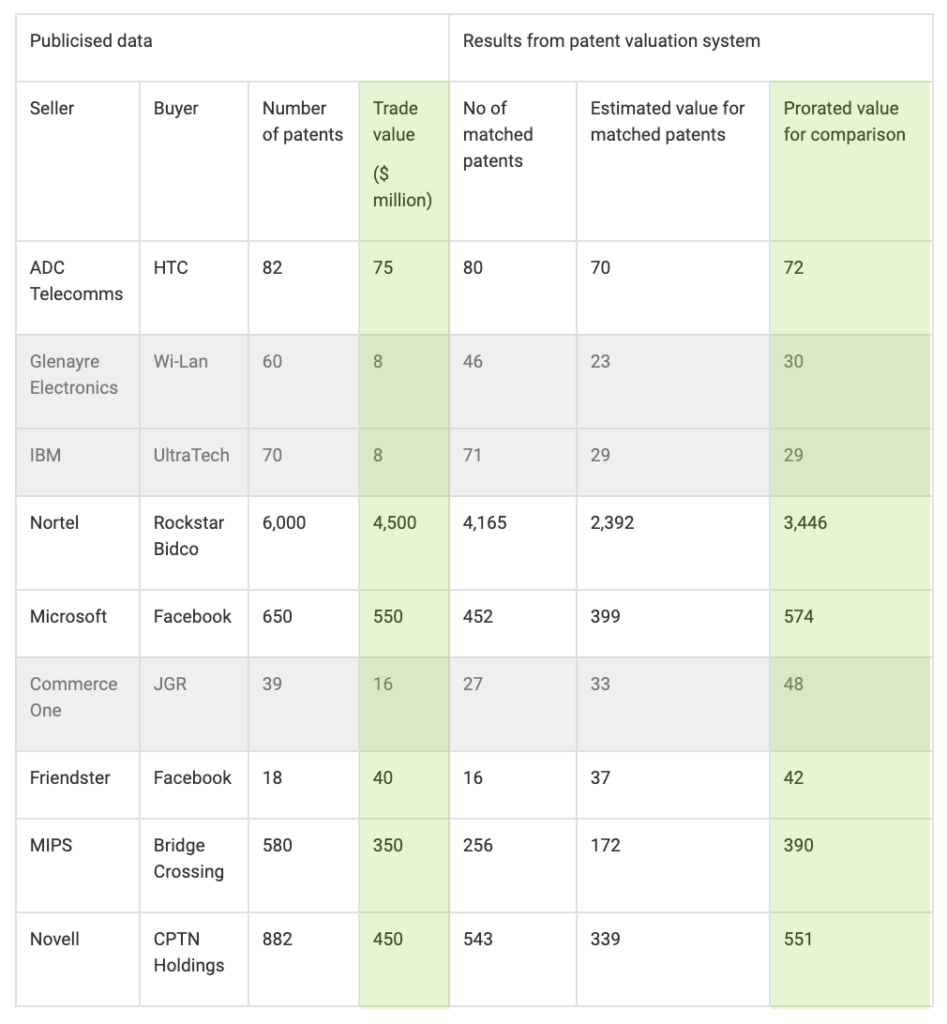

We offer a new, big-data-driven method. In order to minimize subjectivity, we developed a patent valuation system which estimates the profits generated by patents by cross-referencing existing industry financial data and patent data. This method can be combined with any valuation method that requires an estimate of the expected returns generated by patents. Comparisons between the values generated by the patent valuation system and real-life values of actual patent transactions have been carried out in order to gauge the system’s accuracy.

*Discrepancies from the calculated value come from transactions such as fire sale due to bankruptcy or strategic transfer of patents to partner company

IAM Magazine, 8/1/2014

Existing Problems

Currently, the income approach and the option approach are the most widely used patent valuation methods. These use the returns generated by patents to determine value. However, there are many difficulties in estimating patent value using these approaches (eg, estimating the portion of profit attributable to the patent).

1. The existing patent valuation methods may not be suitable for all types of patent owners. It is difficult to account for patent owners that do not manufacture/sell products or receive additional revenues from royalties.

2. An owner’s management practices concerning its patents can significantly affect their value. A patent owner may mortgage its patents and default, yet when the bank attempts debt recovery, a potential buyer may not agree with the patent owner’s initial valuation. The price from such a liquidation sale can diverge substantially from the actual technical value of the patents.

3. Determining patent contribution to a product is not always straightforward. Even if profit data for products incorporating the patented technology is available, only a portion of the profit is actually attributable to an individual patent. Furthermore, a single patent may cover technology used in many different products. In such cases the profits from several different products, perhaps from many different manufacturers, must be combined.

Our Method