PTR: Price to Technology Ratio

Invest In Technology Value

The Story Behind PTR

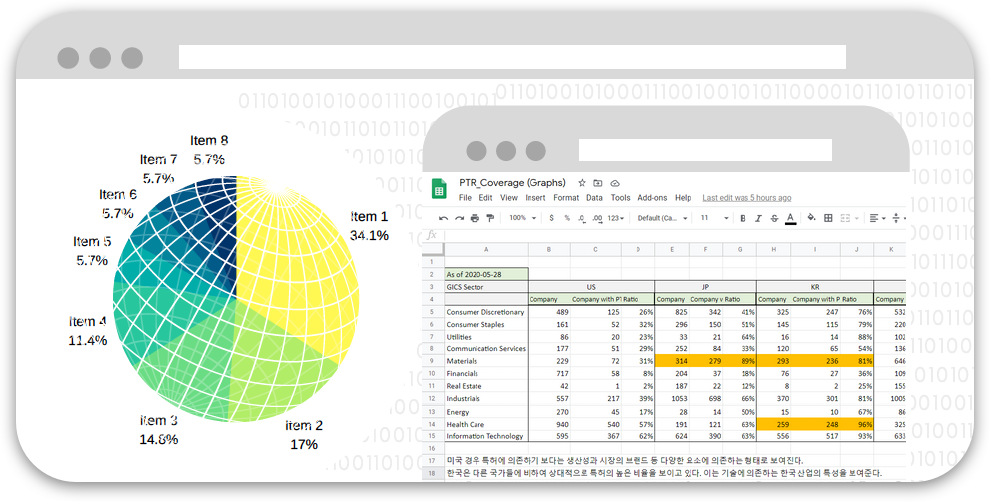

In 2014, Wisdomain, our parent company, released a data-driven patent valuation engine that accurately calculates the monetary value of patents. This technology made determining a company’s total value of patent assets very simple and led us to question if patent asset values are accurately reflected in stock prices.

Subsequently, our team created a new indicator called PTR: Price Technology Ratio. This ratio identifies overvalued or undervalued companies based on patent asset value.

The concept of PTR is similar to P/B ratio, simply replacing book value with patent value. The beauty of PTR is that patent valuation data is not readily available – ultimately preventing it from being exhausted.

Why PTR?

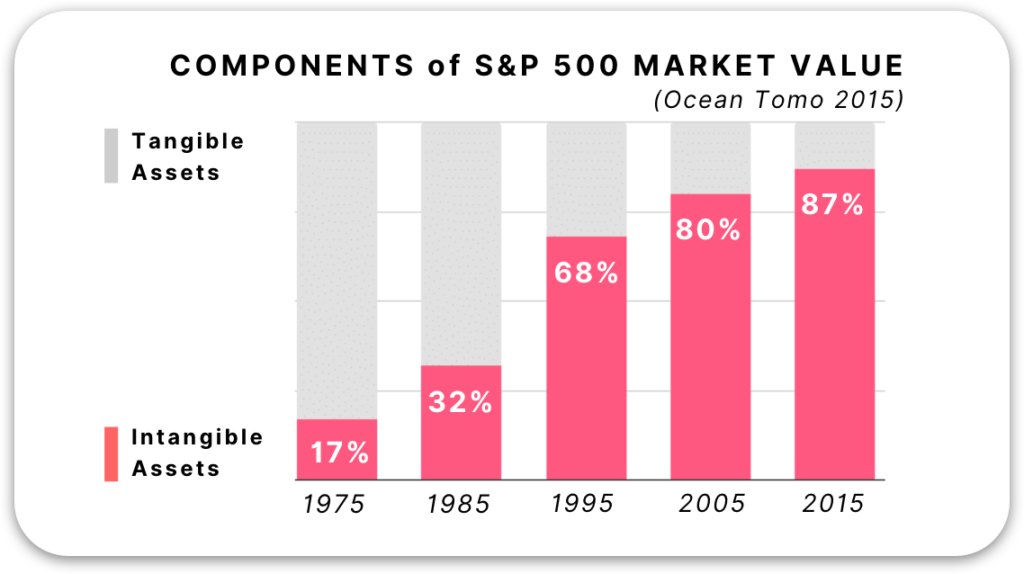

The Growing Significance of Intangible Assets

In 2015, 87% of the S&P500’s market value could be attributed to intangibles on average, compared to 68% in 1995 and 32% in 1985 (Ocean Tomo LLC). Knowing the value of intangible assets is becoming increasingly important to investors.

Patent value makes up a significant percentage of overall intangible asset value.

Big Data Driven Patent Valuation

We define patent value as the sum of the profits which are generated by a patent during its lifetime.

Worldwide patent databases are cross-referenced with financial statements of patent holders. Various algorithms are utilized to calculate profits attributable to patents.

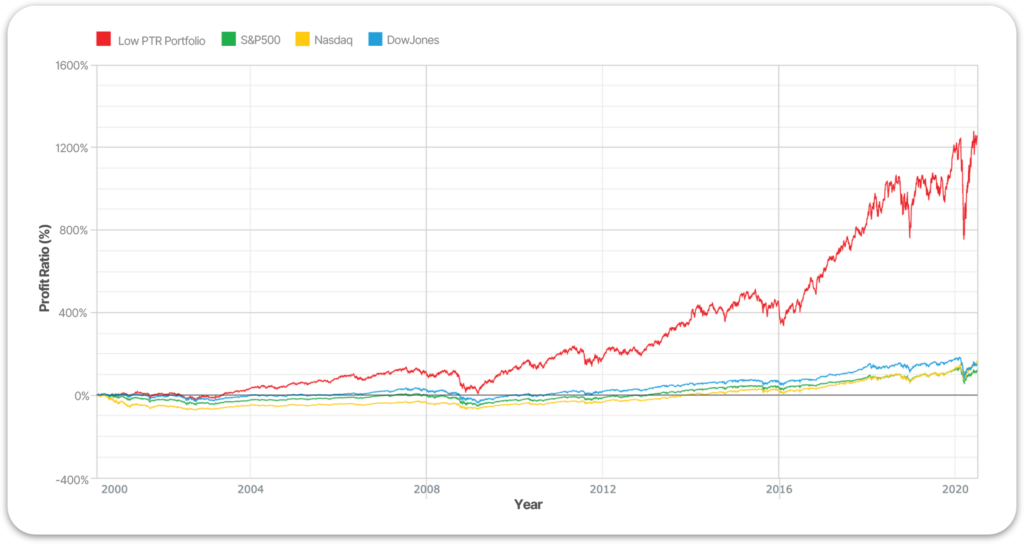

Study Finds Strong Evidence for Return Predictability of PTR

Low PTR stock portfolios have earned significant market excess returns even with a simple buy and hold strategy.

PTR outperforms other innovation-related indicators used in previous studies.